Let’s say that you just graduated college and landed yourself a $50,000 job.

A lot of people think $50k a year is more money than they could ever hope to spend. That they’ll be able to pay down their student loans, live in a nice place, and buy whatever they want and still be able to save!

Is this true?

Well what is true is that 78% of Americans live paycheck to paycheck, and 71% are in debt*. The Median American Household Salary is $59,000**.

So lets break this down. A lot of this will be generalized but bear with it as it may be the most transformative personal finance lesson you ever learn…

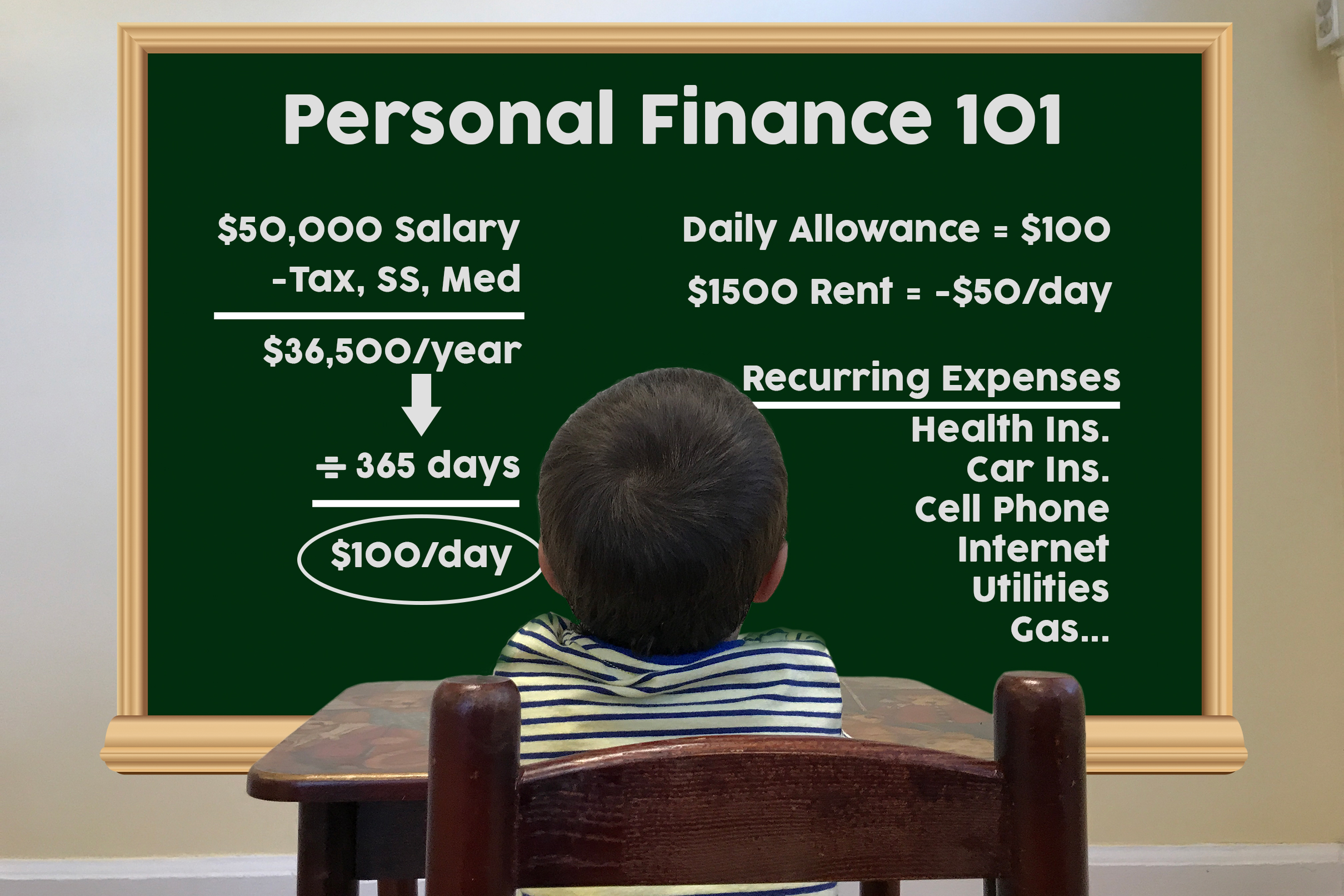

The $50,000 Salary Breakdown

So $50,000 is your salary(income), but you have to deduct expenses like Income Tax(-$8k), Social Security(-$4K), Medicare(-$1.5k).

At the end of the day, you’re really taking home something like $36,500.

Divide that by the number of days in a year, and you are left with $100/day.

Not too bad right? You never spend $100 a day!

Housing

So the most expensive recurring cost for an American is typically their housing cost. That’s why I house-hack and live for free!

But let’s say you rent a $1500/month apartment. Divide that by 30 days in a month, and that apartment is costing you $50/day!

So subtract that from the $100/day you are bringing home, and you are left with just $50/day of spending power…

Recurring Payments

So $50/day that’s not too bad right, you can still go out for a nice lunch and dinner with that and still save something if you skip the dessert…

But wait, what about other things you have to pay for… every single month!

Semi-Mandatory things like:

- Health Insurance: -$250/month

- Car Insurance: -$75/month

- Cell Phone Bill: -$35/month

- Internet Bill: -$35/month

- Utilities: -$80/month

- Gasoline: -$125/month

Total = -$600/month = -$20/day

So at this point, after those limited recurring expenses are considered, we are left with $30/day. But it is precisely at this point that people get in trouble…

They start feeling comfortable. They decide that – you know what, I worked hard throughout college, now I got a good job, I deserve some luxuries – They begin enrolling in and tacking on additional monthly recurring costs like the ones below…

- Student Loan Payment

- Gym Membership

- Amazon Prime Membership

- Netflix

- Spotify

- Car Payment

- Phone Payment

- HULU

- Pandora

- Apple/Google Storage

- Parking

- Magazine Subscriptions

And the list could go on and on but hopefully you are smart and you didn’t fall into that trap…

But we still have one of the most underestimated powerful expenses left…

Everyday Out of Pocket Expenses

Savings = Income – Expenses

So at this point: you’re managing to save $30 a day, that’s $900 a month, or $10,800 a year. Not too shabby.

This can be considered your allowance. This is a very important number to know! Arguably, one of the most important numbers in personal finance.

This number and how you deal with it will ultimately determine whether you will be in debt or be saving. Living Paycheck to Paycheck or Building a Nest Egg. Stressed or Content.

So $30/day is your daily allowance and your potential savings. If you did absolutely nothing, wore nothing, ate nothing – just went to work, then went to sleep. I guess we did budget in gasoline and internet – so between working and sleeping you could drive around a bit and surf the internet, make some calls.

But you do have to eat… are you going to be a person who eats out regularly or buys groceries and makes their own meals?

A lot of people who have a good career, think nothing of buying a $5 lunch, a $10 dinner… oh and that $5 Starbucks latte. After all, they are making $50,000 a year! What difference is $20 on food going to make?

Well I hope you see now… that every dollar adds up and makes a huge difference!

That $50,000 translates to a $30/day allowance, and those meals that day would leave you with $10 to spend.

What else would a normal millennial do on a typical day?

Shop on Amazon? Go out for drinks after work? Go to the mall? Buy an app? Go to the movies? Shop on Facebook Marketplace?

Do any of these things and spend over $10, and you have now expended your daily allowance and are likely on a path towards accruing debt.

Conclusion

I give this $50,000 example, not to scare you into doing nothing. Quite the opposite actually.

“Most of us live our lives by accident – we live as it happens. Fulfillment comes when we live our lives on purpose.” – Simon Sinek

Like the above quote, I want to open your eyes, to convey the importance of living with intention. To have a plan for every dollar.

I’ve often found that the activities I find the most fulfillment through are the ones I’ve paid nothing at all for: Walks, Runs, Hiking, Sports, Reading…

Start to think about all the things you have in your life, and how much of that is actually necessary, how much of it is actually adding value to your life.

Think about unsubscribing from those things you don’t really need. Use resources like your local library.

Maybe consider house-hacking to remove your biggest living expense, or live at home, get a room mate. The possibilities are endless once you start getting creative.

Consider riding a bike instead of a car. Or maybe downgrade that F150 Pickup truck to a fuel efficient cheap Yaris(When you need to haul stuff, rent a Uhaul or Home Depot Truck).

When you go out to eat, don’t order soda or alcohol – get a nice healthy free water (if you’re feeling fancy, ask to add a lemon). Skip the appetizer and dessert.

Concluding the conclusion

So what will you do with all this extra money?

SAVE IT!

Take the 401k match from your employer, then max-out your IRA.

Sure saving never sounds fun, but believe me, having a positive net worth is worlds more fun than drowning in credit card debt.

And you know what is fun?

Retiring at 30 years old! And it all starts right here with this lesson: realizing the importance of every dollar and learning to live below your means.

The next step is to fill out the Financial Overview Spreadsheet to find out exactly what your expenses, savings rate, and net worth are. I’ve even added a calculation for your Daily Allowance after all expenses have been met, and also after you max out your IRA and 401K.

Good luck and Godspeed!

If you are more of a visual learner I created a video going over this same scenario. I actually recorded this over a year ago, it’s an excerpt from episode 2 of the Vailen Venture Vlog.

**https://www.census.gov/library/publications/2017/demo/p60-259.html

One thought on “The Essential Money Lesson You Never Learned in School”

Thank you