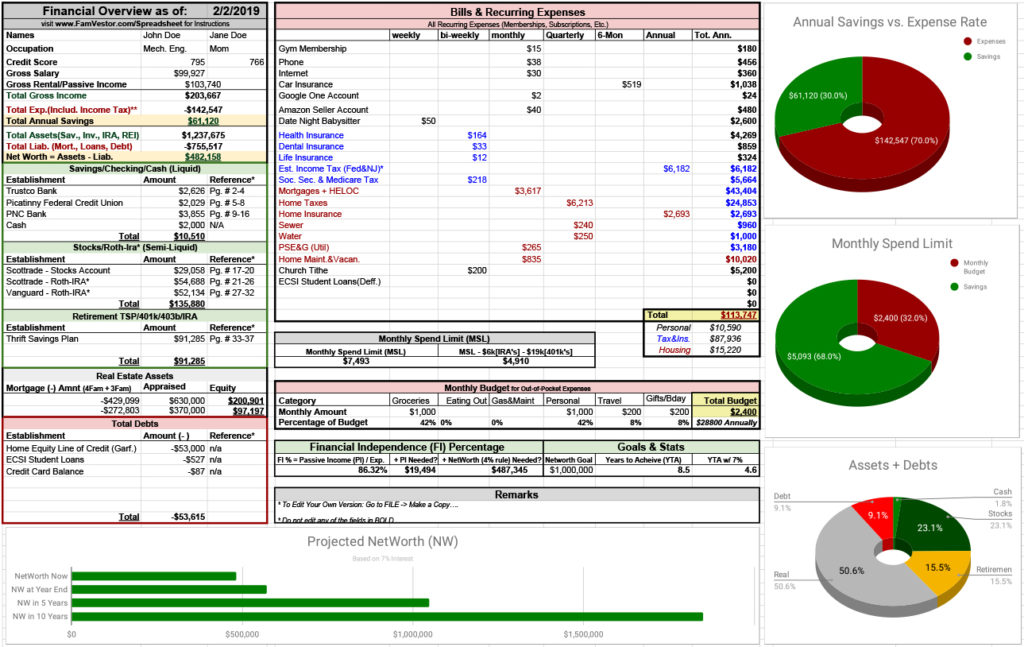

I am passionate about spreadsheets. (I am an engineer, after all). This spreadsheet is by far the best and most powerfully-succinct spreadsheet I’ve ever made. I originally created it to show our banker our financial situation during our cash-out refinance for our home. (Since we have multiple bank accounts, investments, and retirement accounts, it can get messy really fast). But it is perfect for anyone who wants to get started towards financial freedom.

What the Spreadsheet will show you:

- Net Worth

- Annual Savings Rate

- Income & Expenses

- Assets & Liabilities

- Financial Independence Rate

- Time to Goals

Measurement is the First Step towards Financial Independence

When people ask me how to get started on their journey to financial independence, I usually share some audiobooks and tell them that they should fill out this spreadsheet. If you are married, sit down with your spouse and fill this out. It will give you a great picture of where you are with your finances.

You will see where your assets and debts lie, and how they contribute to your net worth.

You will see your complete income, and, more importantly, your expenses. This is absolutely critical, because no matter how much you make, you will always live paycheck to paycheck if you expend at the same rate that you earn.

That is why even though it is probably the hardest to calculate, tracking your expenses is the most important thing you can do.

Expenses

In this column, you want to record all of your recurring expenses: subscriptions, monthly bills, annual fees, and anything that you know you will have to pay. This works extremely well, if you can maintain a daily expenditures budget. I go into this in detail in Episode 2 of the Vailen Venture Vlog. We allocate ourselves $450/month each to spend on any out-of-pocket expenses (gas, dinner out, clothes, groceries, etc.). Any expense that was not already covered in the expenses column gets captured here. We track all our daily expenses using the Saver App.

The beauty of doing it this way. Every single expenditure is covered and you can calculate fairly accurately how much you will be spending for the entire year. And since 90% of people know exactly how much they will make this year from their salary, you can now know how much you will be saving.

Savings

Savings = Income – Expenses

Have a goal to save even more? Maybe you calculated that you are only saving $8,000 a year, but you want that number to be $10,000. Look at your recurring expenses to see if there is anything that you can do without. Is there something that you can give up in order to meet your goals? You can also reduce your monthly budget amount to try to meet your goal – but be reasonable with yourself.

So where is this money from your savings going? For me, I first make sure to fill our Roth-IRA’s ($5,500 each), and then my 401K($18,000). If you don’t know anything about IRA’s, my general recommendation is to open up a Vanguard Roth-IRA account, and start contributing towards your Target Retirement Age Mutual Fund. I have the 2050 target retirement fund, stock ticker: VFIFX . Another added benefit to this fund is you only need $1000 to open it, and the expense ratio is relatively low at 0.13% .

Net Worth

Net Worth = Assets – Liabilities

- In 2011, my Net Worth was in the negatives because I accumulated about $15,000 in student loans

- Once I graduated in 2013, my net worth was about $35,000 so grateful for the SMART scholarship I won.

- By 2015, my wife and I were making well over $100k. As a teacher, she was making 50k and as an engineer, I was making 70k. We were living with my parents and saving every penny we could. By the middle of 2015, we had a little over $100,000 in net worth.

- Now in 2016, thanks to the great reappraisal on our house, we are quarter-millionaires with over $250,000 net worth.

I share this with you to hopefully inspire you. We went from having a negative net worth to being quarter millionaires in 5 years. We did it with frugal living, smart planning, measuring, and sticking to a budget.

Many people think of millionaires and assume that they have $1,000,000 sitting in their savings account at Chase Bank. Not true! To be a millionaire, you need to have a million dollars in assets. Some of this will be liquid (like the money in savings and checking accounts), but much of it is in retirement accounts, brokerage accounts, real estate, and other investments. These are all assets, and if you are a smart millionaire these assets will be making you money, hopefully with greater than 8% annual returns. If you are a dumb millionaire, maybe you will have $1,000,000 sitting in your Chase Savings Account collecting .01% annual interest.

So let’s calculate your net worth: Add up all your bank accounts, retirement accounts, your house value, your car value, and all your material possessions’ market value. Then add up all your outstanding debts: student loans, credit card debt, the $5 you borrowed from your coworker for lunch, etc. Subtract the two and that is your present net worth.

Hopefully it’s positive, but I know that for many, it will not be. Either way, I urge you to read my post on budgeting, fill out this spreadsheet, mark this down as year one, and create a new duplicate tab to update every year. It is really awesome to see your net worth growing from year to year.

I wish you all the best of luck, and Godspeed!

12 thoughts on “The Best One Page Financial Overview Spreadsheet Ever Made!”

Do you add all the mortgages if you own more than one home, and enter the total? Then the appraised value for all to determine equity on all?

You could do it that way if you want. I would personally just create a different row for each property and determine the equity individually. Then just make sure that new row is being added into the Sum formula for the net worth calculation.

I had a question regarding the Reference Pages. What do these reference? What is the “Financial Binder”?

Thanks!

Hey Charlie, so as I mentioned in the post I print this sheet and have it be the cover sheet when I’m applying for a mortgage. Usually the bank want to see the last two statement from all your financial institutions(Banks,IRAs, 401ks), so I usually download PDFs for all those docs, make a digital pdf binder of all of them together, digital number them and print it out to give to my banker, with the sheet reference as a table of contents. Hopefully that made sense.

I must say it was hard to find your site in google.

You write interesting content but you should rank your blog higher in search engines.

If you don’t know 2017 seo techniues search on youtube: how

to rank a website Marcel’s way

Thanks for the tip, watched some helpful videos. My main focus has been putting out quality content. But yea I should start incorporating more SEO techniques into the posts.

It looks like your estimated taxes are ~$11,000 (Fed, NJ, and FICA) on gross income of ~$180,000, but that seems really so low. I am projecting estimates taxes of ~$23,000 (Fed, LA, and FICA) for my wife and I on gross income of ~$120,000. Btw I really enjoy the blog and appreciate all the information you posting. I just found it this week after BiggerPockets posted one of your articles.

Hey Dylan thanks for the post, well last year we only paid $7,300 in federal taxes and $1,500 in state and that was with only 1 baby.

Now we have 2 babies, and I guess I did get a raise at work, but I think the capital expenditures of this new property as we renovate will offset the new income and we should still be low. I do use a CPA by the way. Anyway I’ll report back at the end of the year.

Keep in mind that even though we have ~$180k in income coming in, we have $82k in housing expenses alone. Most of which is tax deductible, also there is depreciation to consider.

Thanks for the amazing spreadsheet! I will replace the several that I made for the various purposes that you cover in one–plus so much more than mine can do!

Hey thanks for the comment David. Glad you could make use of it.

Hello! How do I account for my weekly paycheck deductions into a 401k on the spreadsheet?

Hey Katie it could be done but it would make this spreadsheet far more complicated.

I just wouldn’t worry about it. Put the legitimate real deductions from your paycheck in the expenses tab.

But for any allocations towards savings I would just ignore it. And it will show it just as a general savings and flow into the savings rate on the left side of the spreadsheet.

Hope that makes sense.