On October 7th, 2015, we finally closed on our first piece of real estate – a 12-Bedroom Quadplex in Bergen County, NJ! It was a long journey that concluded after four months of back and forth with the bank, two years of searching for homes, three years of researching real estate investment (REI), and seven years of striving to buy my first home by the age of 25.

Above is our interview on the BiggerPockets Podcast discussing this deal. Skip to 4min and 50sec to get to us.

Numbers!

Listing Price: $475,000

Offer Price: $480,000 [offer sent on 6/22/15]

Purchase Price: $430,000[closed on 10/7/15]

Down Payment: $43,000 [10% down, No PMI]

Closing Costs: $9,842

Mortgage Loan Amount: $387,000

Interest Rate: 3.99%

Expenses for the House

Home Mortgage: $1845/month

Property Taxes: $10,912/year

Home Insurance: $1,978/year

Sewer Bill: $120/quarter

Water Bill: $120/quarter

Utilities: ~$120 month[Electric is separated, but we pay Gas]

Total Expenses: $3400/month (Excluding Vacancy, Maintenance, Property Management Fees)

Income for the House [4x 3Bedroom Units]

Unit 1: We live for Free

Unit 2: $1000/month (Discount to In-Laws)

Unit 3: $1700/month

Unit 4: $1700/month

Total Income: $4400/month [Excluding CoinOp Laundry and Parking space Income]

Cashflow = Income – Expenses

$4400 – $3400 = $1000/month. We make $1000/month on this house while living in one of the units. Once we move out, we can easily get another $1500/month for that unit, and if our parents ever move out, we can likely get an additional $500/month for their unit.

…+$1500 +$500 = $3000/month

This house would be making us $36,000 a year! Of course you should factor in that their will be vacancies, necessary maintenance and repairs, but still that is a lot of income.

On top of that, in 30 years, we will have a fully paid for house, without having to put any of our own money to pay for it. We also get all the tax deduction that come with owning a home and a rental property.

Resource: this spreadsheet is the tool I use to analyze properties, keep rent roll, track expenditures, etc.

A little more about the property

The property was only listed on the multiple listing service (MLS) for three days when we saw it and put an offer in. It was a real estate-owned home (REO), which means it went into foreclosure before the bank(Wells Fargo) took ownership of it. Sure, it needed some repairs and was the “ugly house” on the block. But we knew that with some hard work, we could turn this home into a nice nest egg. Plus, property taxes would be cheap and we were out of a flood zone.

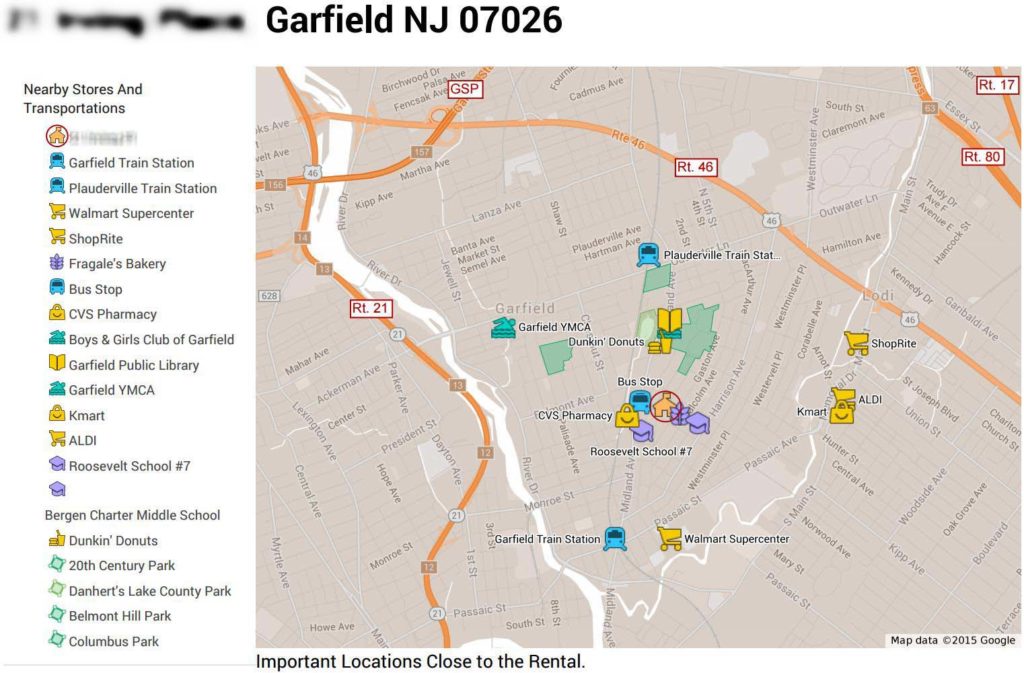

I’ll paint a picture for you so that you can see what we saw: imagine a four-family property with two houses on one lot. There are 12 bedrooms and four baths. The house is only two blocks from a nice park, and two blocks from a bus stop that takes you into Manhattan in less than 40 minutes. Plus, it was less than a mile away from a train station. We knew that it was a diamond in the rough.

About a month before, we put an offer in on a similar property that was only a few streets away from this one. We offered $26k over the asking price and were still outbid by a full-cash investor.

This time, we didn’t want to be outbid. But this house was crawling with investors. We saw them lurking around every time we stopped by to check out the property! We did have one unique advantage, though. Since this was an REO, for the first 12 days that the property was listed, the bank would only allow offers from investors who planned to live in the property once they bought it. Still, we needed to beat the competition, as two other people were bidding at the same time as us.

What gave us the edge?

For one, the bank had preapproved us already, so they knew that we were serious. But I think the real advantage was that we chose not to use a realtor. We had searched around for a good one, but never made the commitment to anyone. We didn’t want to be pressured into buying a property after dragging a realtor along to see 100 different houses. And, we felt that we would have a real advantage without one. Normally, when a house is bought, there are two agents (the agent that the buyer uses, and the “listing agent” that the seller uses). Once the house is sold, the two agents split the commission (usually they both get around 3% of the property value). But, if we have no realtor (AKA, no agent), then the listing agent gets to keep the full commission (around 6%). This is a major incentive for the listing agent to have us buy the property..

Still, we didn’t want to take any chances. We put in a bid that was $5k over the asking price. Six days later, our offer was approved! Now came the hard part of doing the due diligence.

Due Diligence and how we saved $50k

Before we placed our offer, we had a friend (a contractor) walk through the property to check it out. Then we hired a home inspector to do a more thorough run-through. We found him through Angie’s List, a reliable website that has reviews of local businesses. He charged $805 to inspect both houses and included Termite and Radon Testing. If you would like to see a copy of our Inspection Reports, you can find them here:

Below are some of the findings of the Inspection:

- Slightly Sagging Second Floor Kitchen

- Asbestos Insulation on some pipes in basement

- Possible puddles in basement maybe due to water seepage (although I think it was due to dripping hot water heater)

- Small leak in main sewer pipe

- Decommissioned oil tank in the ground

- An illegal 5th unit, now considered a bonus room, with a separate basement.

- Significant water damage and mold in the basement

- Some Cracks on outside Masonry

- Some signs of termites

- Missing Flashing around house

The oil tank was the biggest red flag. To ease our fears, the bank agreed that they would excavate the oil tank prior to closing. Still, we were scared. After posting on www.biggerpockets.com , we found reassurance in the words of other investors.

If you are interested in Real Estate Investment and you haven’t checked out biggerpockets, you have to go there! The only reason I even ever considered real estate investment was because I started listening to the biggerpockets podcast. My original goal, even after listening to Rich Dad, Poor Dad. Was to buy a house outright by the time I was 25. I figured if you had a paid off house, you could save a lot more money, and wouldn’t be losing money to interest over 30 years. After stumbling onto the biggerpockets podcast while searching for tips on purchasing homes, I was enraptured. I loved hearing first hand how other investors did it. And my goal changed to buying a Rental Property by 25 – which I did. And that was only three years after beginning to listen to biggerpockets.

Okay, sorry for digressing – back to the story.

Originally our goal was to spend around $25k to fix up the property and separate the heating utilities (one furnace heats the rear building and one boiler heats the front). But we weren’t sure if that goal would be realistic after seeing the inspection.

To ease our fears, we reached out to a nearby investor on Biggerpockets. He and his wife came to take a walk through the property. They gave us a ton of great input on what could be done. They also told us what we didn’t need to do. My wife and I both felt a lot more comfortable after meeting with the two of them. (Thank you Marcin).

A week after our offer was accepted, we met with a plumber, a paver, a basement water-proofer, a carpenter, a termite guy, an asbestos-removal guy, and a mason! It was a busy week getting quotes from all of them. We found all the contractors on Angie’s List. We hoped that these quotes would convince the bank to get things repaired or credited before closing. We knew that banks don’t normally make concessions, but they seemed to have conceded on the oil tank. We thought that perhaps they would concede on some structural and hazardous issues as well.

These were the quotes we got that week:

- Asbestos Piping Insulation Removal (170 linear feet)- D&S Restoration – $1900

- Mold Remediation, And Basement Waterproofing on Secondary basement (flashing, drain pipe, drain baseboard, sump pump and pit, re-cementing the floor) – A1Waterproofing – $5,850

- Demo the illegal 5th unit structure – $15,000

- Replace Section of Cracked Sewer Line – Promen Plumbing – $2000

- Replace Steam Boiler – Promen Plumbing -$5300

- Install second furnace and hot water heater and separate heat in units(1st house) – Promen Plumbing – $12,000

- Reinforce Beams between first floor Kitchen Ceiling and 2nd floor kitchen floor (6 new beams and sheetrock, spackle, paint) – J&B Contracting -$3400

- Termite Treatment [Said no visual termite damage just signs of mudtubes and termite presence] – Aries Termite Control – $1650 for both houses

- Redo the whole driveway in Asphalt – Boyd Paving – $9,800

- Redo the whole driveway in concrete – Boyd Paving – $21,000

- Redo sidewalk – Boyd Paving – $5700

- Repair cement siding on rear unit (Crack in masonry) – Bergen Mason Contractors -$1500

Oil Tank

So back to the oil tank, we performed an oil tank inspection and found one under the driveway. The Inspector, thought that the oil tank had been decommissioned, since it appeared to be hollow and filled with sand.

As mentioned, we asked the bank if it would pull it out for us, and they said yes. We gave them three quotes, which all said it would cost around $1500. A few weeks later, the bank actually tried to weasel its way out of removing the oil tank by offering us the $1500 credit instead of taking it out themselves. Of course, we said no. They had agreed to do it—and they would have to do it.

We went back and forth like this for three more weeks. We finally told them that we would take it out ourselves if they gave us $50,000 cash back at closing. They offered to instead take $50,000 off the purchase price of the home. We agreed, and cut the price of the home from $480,000 to $430,000. Of course, we would have preferred the cash in hand, but we knew that this was still a good deal.

Before accepting the offer, we performed soil sample tests around the home to make sure that the tank wasn’t leaking. We’ve heard horror stories of oil spills, and soil remediation efforts costing hundreds and hundreds of thousands of dollars. So we wanted to try and mitigate that as much as possible.

Why did they bank take $50,000 off the purchase price, instead of paying the $1500 to remove the oil tank themselves… not really sure, maybe they were just tired of dealing with us – or maybe they didn’t want to take the chance of having a soil remediation project on their hands. Either way we felt the $50k was worth the risk after we did our due diligence with the Oil Sample Tests.

Before/After Photos

So it was a long fall/winter of repairs. But the amazing thing was… that we closed on Oct 7th, and we left for a 3 week long backpacking trip through Europe on Oct 15th. We had booked the trip months back using Flyer Miles, when we thought the house was going to fall through due to the oil tank. Anyway it was an amazing trip, but we were sorry that we were losing the warm days to work on the house. Anyway when we got back on Nov 2nd, we lucked out with super warm weather and got a lot done.

Some more pictures!

We tried to do as much of the work ourselves as possible. In the end, we only had to hire two contractors to refinish the wood floors and repair the chimney, everything else was done by us or friends.

The Kitchen we bought used on Craigslist

The kitchen in the fourth unit was severely outdated. So, we decided to renovate it. A whole group of our friends helped us demo it. Then we put in a used kitchen that my wife found on Craigslist for only $1,100. It came with plywood cabinets, stone, and a sink. We had to do a little bit of finagling to get everything to fit right, since it wasn’t custom. But, you can see for yourself, the end result is not bad. We also bought the refrigerator, stove, and vent microwave on Craigslist. A big thank-you to Branch, Naria, Victor, Karlsun, Andria, Victor, Joy, Grace, and Kuni – we could never have done it without you guys!

Cabinets/Stone/Sink: $1100

Refrigerator: $750

Range/Stove: $390

Microwave: $125

Tile + Glue + Saw Rental: $428

Sink Light: $15

Receptacles:$60

Trim: $15

Total Kitchen Renovation Cost: $2,883

And the pictures continue… a lot of work went into this house.

In total we put another $20,000 into the property to complete all these renovations. During the course of the winter we made over 30 Round Trips to the Local Home Depot. By February, we were ready to start advertising the rental units. So in February, we started Advertising the Rental Units.

Attracting Quality Tenants

After renovations were complete, we started advertising. It was painful to hold the property for 4 months without having renters in the other units. Every month, we paid thousands of dollars in holding costs. For this reason, it is sometimes cheaper to pay a professional who can get the job done more quickly than you would be able to on your own. (Our property cost us $3,400 a month just to operate, without even adding the additional repair costs.)

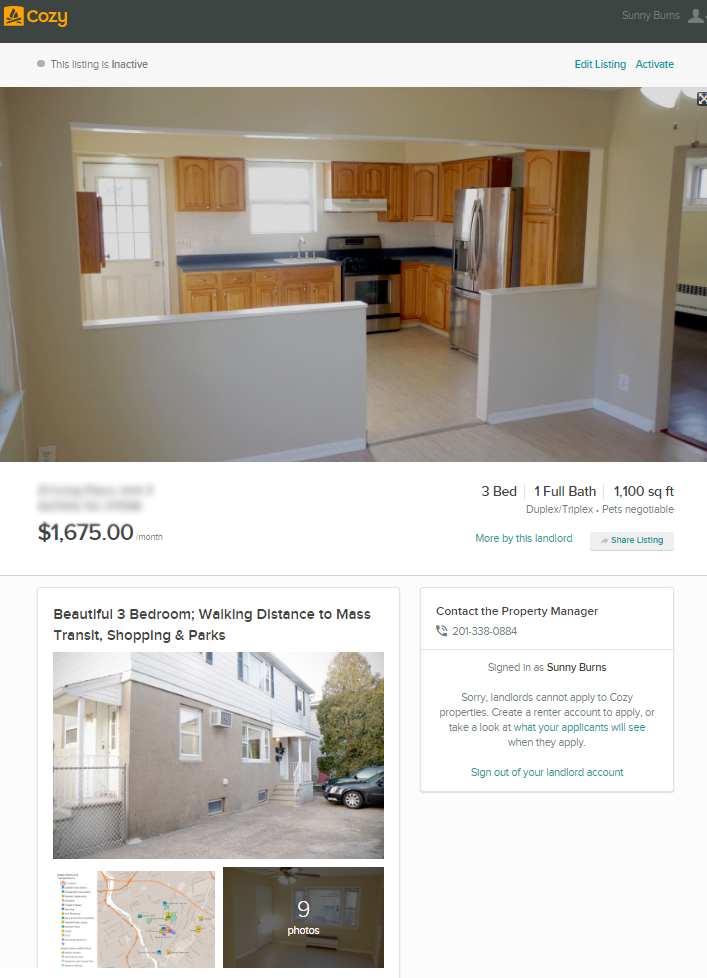

Advertising

Anyway back to the tenants; We started by taking really nice pictures and creating a listing on Cozy.co. We love this site! Potential tenants can apply to rent your property directly from the listing you create, they can submit a credit check and background check all through the site as well. Then, after you select your tenants, they can pay through the site. You never have to go hounding people for rent checks, and no tenant can use the excuse that the check is in the mail. All you have to do is check online to see whether they paid or not. We highly recommend using Cozy.Co. The best part is that it is completely FREE!

We advertised on Craigslist, Trulia, and Zillow.

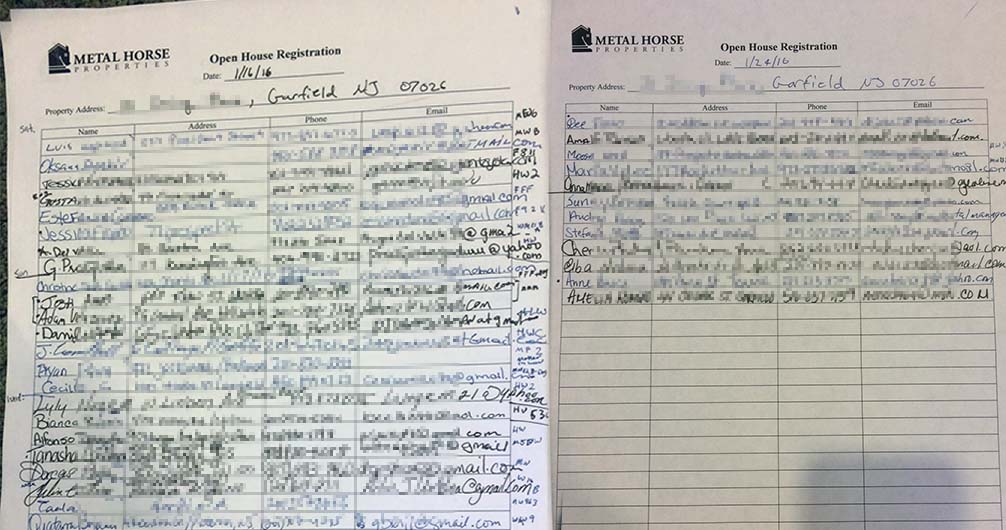

We held three weekends of open houses.

In just two weekends, Over 30 Groups came in to check out the apartment.

Interesting side note, We were able to shift $1200 of our rental income to Vailen this year. We paid him to help market our rentals to families during our open houses – a baby model. There wasn’t a significant tax savings, I think we ended up saving $10. But the real achievement was Vailen had earned income at the tender age of 0. And we were able to open a Roth IRA for him – here’s to tax free earnings for the next 59 years

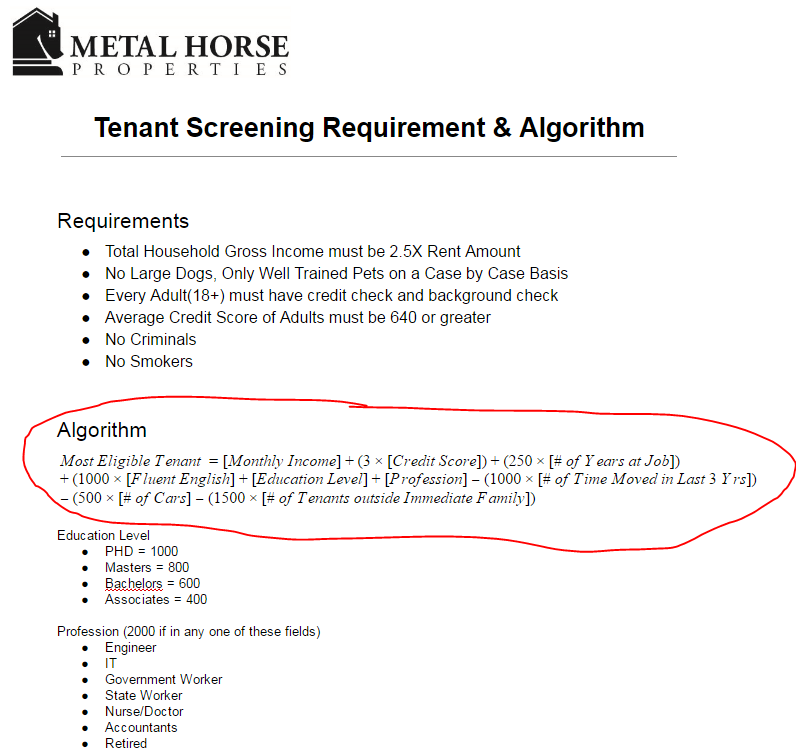

Choosing the Tenants

Once all the background checks and credit scores were submitted with the applications, we were ready to compare the offers. We did this by creating a complex algorithm to determine how we would choose our tenant:

In March of 2016, both Tenants Moved into Unit 3 and Unit 4. They have been great!

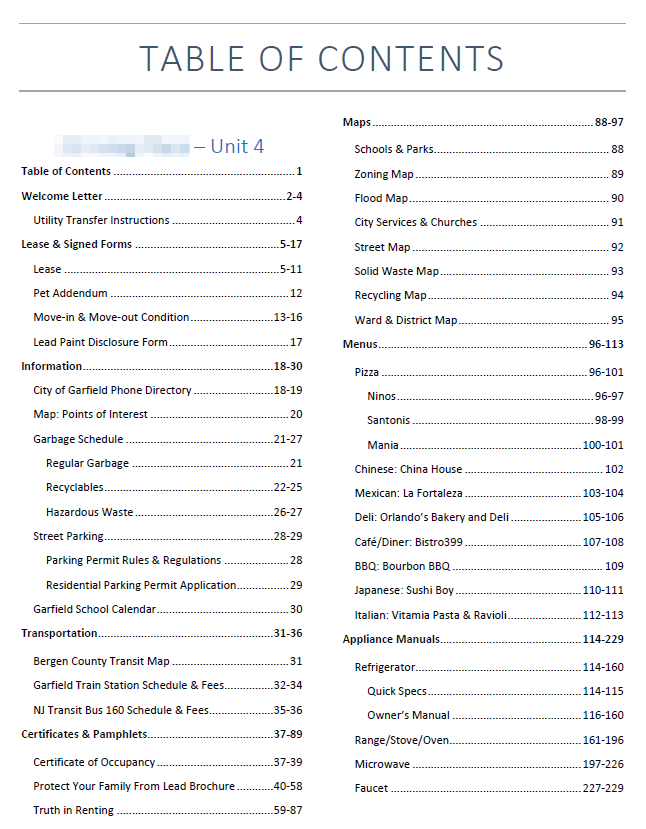

Apartment Binder

We also made a pretty extensive apartment binder. It has everything in it and was just shy of 230 pages. We included signed copies of the lease, local menus, city information, school schedules, trash pickup schedules, appliance manuals, you name it! If it had to do with the town or the apartment, it was in there. I think this showed a level of professionalism and a sincere effort to welcome our tenants so that they felt comfortable in the apartment. We also left each tenant a welcome basket with basic apartment necessities: toilet paper, 3M command strip hangers, felt sliders for the hardwood, bottled water, and soap.

Refinancing

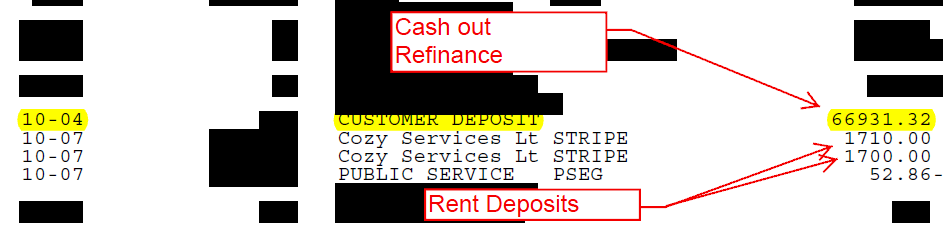

On July 28th 2016, about 9 Months after purchasing the home we applied for a Cash-Out Refinance. On August 28th , we received our new Appraisal Report, and our house Appraised for $550,000. That’s $120,000 more than we bought it for less than a year ago.

We chose to refinance so that we could get a lower rate and pull out our invested cash.

We purchased our house for: $430,000

We put 10% down, and got a Loan of: $387,000

Our appraisal, just came in at: $550,000

By my calculation, the Equity we have in the Property is: $550,000-$387,000 = $163,000

so

$163,000/$550,000 = 29.63% Equity

So we went from 10% equity to 30%. And we went from a 4% Mortgage Interest Rate to a 3.5% rate.

On September 29th, we finally closed on our refinance. Total closing costs were a lot lower than expected (only $1,646). We ended up pulling out just under $67,000 for our Cash-Out Refinance. This amount is almost dollar for dollar what we put into the property. We originally put in $43k for our 10% down payment, and ~$25k for renovations. And the real beauty here is that after pulling out all this cash, we still have a higher equity position in the house than when we first purchased it.

Conclusion

That’s our story—a true BRRR story (buy, rehab, rent, refinance, repeat). Brandon Turner would be proud. Of course, there’s a lot more that we could go into, but I will save that for later posts. I hope that this page was helpful to you. Let me know what you think in the comments below.

We are now searching for our next property to do it all over again.

15 thoughts on “Metal Horse Properties: Our Real Estate Investment Story”

Thanks for sharing your story Seung Kook! It’s really inspiring and I learned a lot from reading this post. I’m going to check out the podcast you mentioned. I’d love to be able to do something similar one day.

Hi,

You guys remind me so much of my wife and my newborn baby Stefan!

I love what you did!

I am currently seeking to get Funding from NACA a hud type of lender.

Once I secure the funds I would love to invest into a MF some place in NJ along the Hudson.

If you would like we could perhaps partner on it.

You can find me on BP PRO Dejan Davidovic.

Let me know your thoughts.

Godspeed!

Hey Dejuan glad you liked the post. Haven’t heard of NACA but I will look into it. Not exactly looking to partner on anything right now, but if the deal is good enough… Right now we are just in search of another triplex or quad we can repeat the process with. We should be able to finance it ourselves through conventional financing.

I thoroughly enjoyed reading about this project. I have to admit I’ve never thought about buying multiple unit properties and it’s definitely opened up my eyes. Thanks for sharing and I know I got some work to do this weekend 🙂

Wow. Great post. So much detail. I’m trying to do the same thing in the Clifton area. Loved your podcast episode on BP.

Thanks. Clifton has a lot of multi-family, probably a good area. It also has a train line to the city. Good luck!

Hi Sunny,

This post is AWESOME. I’ve been following you on BiggerPockets and listened to your podcast episode and have learned a lot. I’m in the process of closing on my first property (a duplex) and will be house hacking and implementing the BRRR method as well. Great to see such detailed content that answers all the little questions one might have through the process.

I will also be documenting my journey at my blog, http://www.rentalstowealth.com . Still trying to get a hang of this whole website thing but for now it works! Judging by the BP forums, looks like you’re looking for property number 2. Good luck and I look forward to your future posts!

Hey Lauren, thanks for the comment and yes we should be going under contract with property #2(triplex) any day now. Checked out your blog real quick, nice to meet another New Jersian seeking early retirement. What town/county are you looking in? Your $400/month cash flow per unit goal includes a mortgage payment?

Hi Sunny, thanks for the quick reply! I’m originally from your area, West Paterson, but moved to South Jersey last year so we’re looking in the Camden County area.

The $400 cashflow per unit does not include a mortgage. Our goal is to acquire all of our properties by 2034, use the snowball method of using the current cashflow to pay down the mortgages and have them all fully paid off by 2044. And then once they are paid off, cashflow $400/unit after accounting for vacancy/repairs/capx/PM.

As someone already doing what we hope to do, I’d be interested to know if you see any holes in our plan.

Thanks!

Hi Sunny!

That was an awesome post! I had a question regarding Trustco Bank, did you do your pre-approval with them? Also was it an FHA loan you got with them? I looked up there website and don’t see the FHA loan but did see the 10% down 30 yr mortgage.

Would love if you could help answer this, thanks!

Thanks Adolfo, no we have never done any FHA loans. Trustco will give you a conventional 30 year mortgage up to four units on an owner occupied residence and you just have to put 10% down and the best part is there’s no Borrower Paid PMI.

Rates are great too, we just locked in for our second investment property that we currently have a contract with at 3.875%.

Sonny, regarding the termites. Did the bank give you a credit for the treatment? Did you end up getting a treatment? I’m looking into a house and I’m in the same position as you were.

Thank you for posting extra pictures! I so enjoyed reading your story. I read your post that BiggerPockets emailed this afternoon and can’t wait to listen to the podcast. We are in our first house-hack and, like you, have no desire to build an enormous empire. We love your story! Thank you for sharing!

Hey Kristina that’s awesome! Yea depending on the area and done right you only need a couple properties to achieve financial freedom. Best of luck to you guys!