For my wife and I, one of our greatest passions is traveling. Like many others, we were frustrated with the high cost of airfare and lodging. We would look for the cheapest fare by scanning flights on Kayak.com , but we knew there had to be a better way…

Travel Hacking is a strategy to book free flights using frequent flyer miles acquired through credit-card sign-up bonuses.

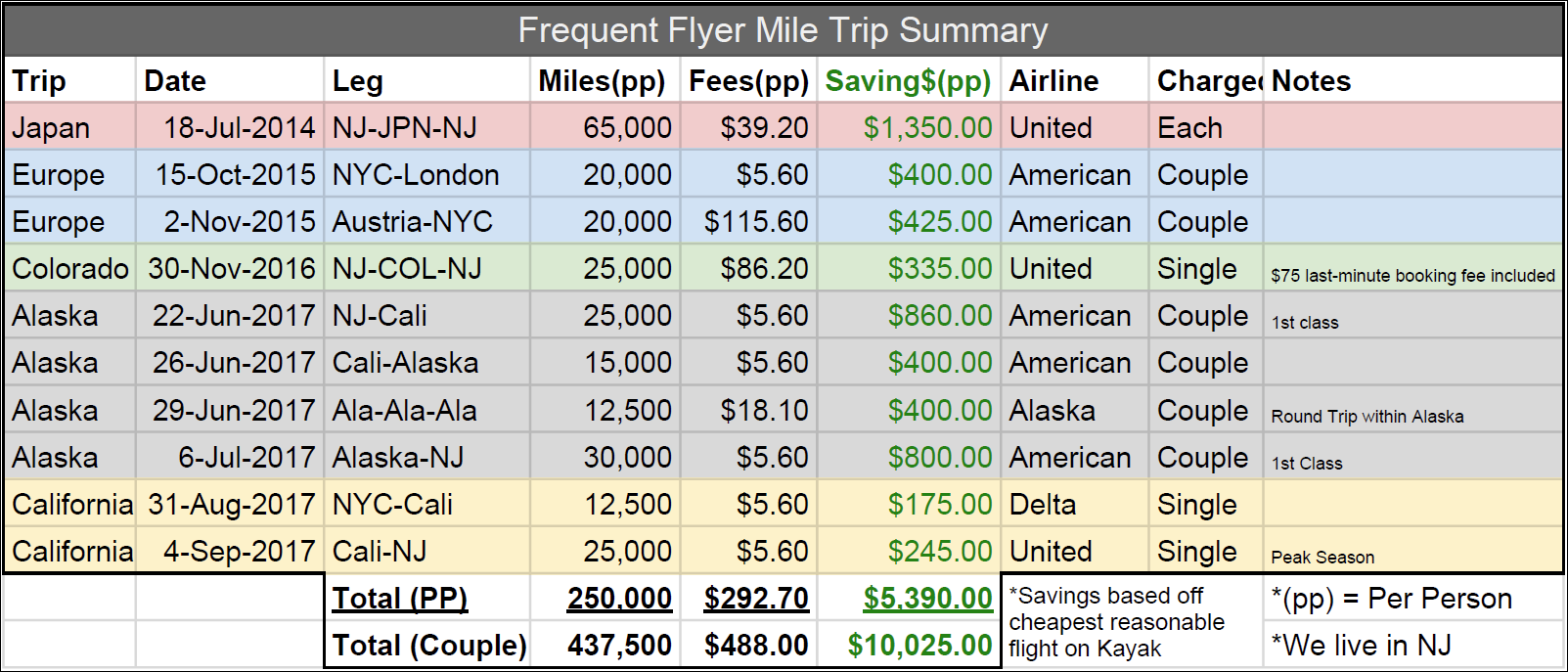

Three years ago, we discovered Travel Hacking and Airline Credit Cards and have never paid for a flight since (saving us $10,000 in flights).

In the last three years we opened 22 credit cards and have been able to fly to Japan, multiple countries in Europe, and Colorado practically for free (some taxes and fees).

We already made itineraries for this summer with a wedding in California and an excursion to Alaska, all paid for with frequent flyer miles! See below for all the trips we’ve booked with miles!

Tip: If you do not have the financial IQ to pay off your credit card each and every month, you SHOULD NOT get a credit card! There is no point in getting a 2% cash back credit-card only to pay 15% in late credit card interest payments.

Our Basic Mileage Accumulation Strategy and Tips

- Find a high sign-up bonus airline credit card

- Generally 50,000+ miles upon sign-up is good

- Go for offers that waive the first year’s annual fee

- Generally 50,000+ miles upon sign-up is good

- Apply for the card, one at a time

- Sign up first, then spend the required amount to achieve the sign-up bonus

- Spending requirements span from $1,000-$3,000(Tip: If you don’t normally spend the $1000/month – either don’t get the card or wait till a big bill is coming up like an insurance premium before signing up) within the first three months to qualify for the bonus

- After fulfilling my spending requirements, my wife signs up and we do the same steps for her

- Sign up first, then spend the required amount to achieve the sign-up bonus

- Cancel the card before the year is up

- This way you avoid the annual fee, generally about $100/year

- Another advantage is that usually you can re-apply for the same card two-years later and get the sign-up bonus again!

- In our case, we are already on our second United and American Airlines cards

Even though we cancel a bunch of cards, it doesn’t really affect our credit score (we see a slight 10 point ding, but the next month it goes back to where it was), we both maintain credit scores in the high 700’s.

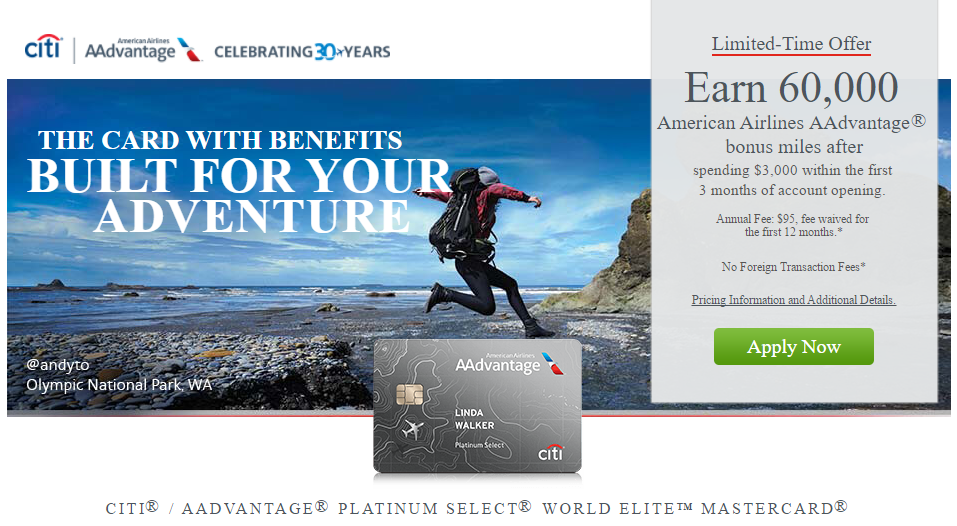

Below is a good example of a promotional offer going on at the time of this writing, through American Airlines. This is something that we would typically go for. Good Bonus-Mileage Amount, Annual-Fee Waived, Relatively Low Spending Requirement.

Using Miles for Trips (Tips and Tricks)

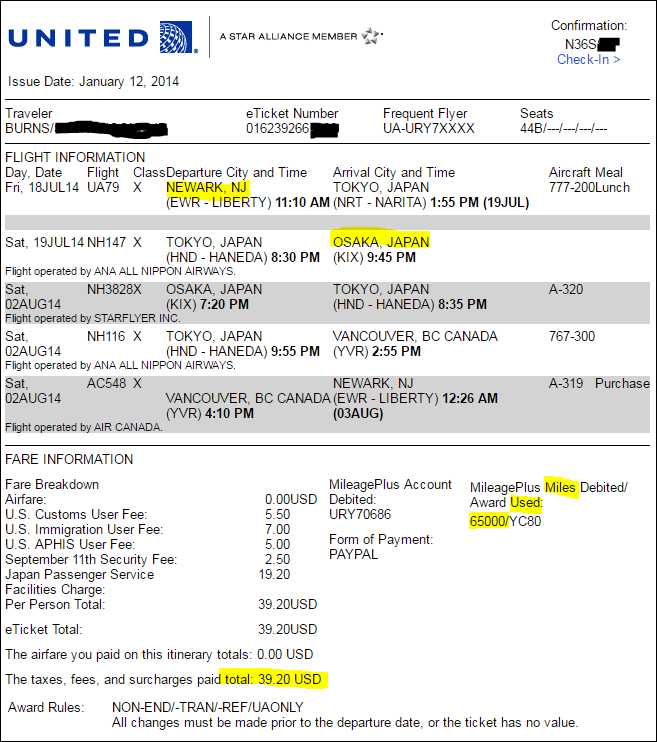

Book early to optimize your miles [Japan, United-Airlines, 65k miles (pp)]

So what can 50,000 miles buy you anyway? Here is where the discipline comes back in. You can use your miles to book a flight the next day, but you will likely pay double the miles for it. Take our Japan trip as an example:

We booked the trip more than 6 months in advance! Why? Because we were flying in peak summer season, so we had to book early in order to get the best rate of 65,000 miles. If we waited too long, all the “saver flights” would have been taken, only a couple available per flight. Saver flights are half the miles of a regular flight, so if we were to wait to buy our flights closer to the time, it could have cost us double the miles at 130,000 miles!

Every airline has their own rules for frequent flyer miles, but for the most part, the rules are the same. There are a couple of “saver” seats available on each flight, but once those are gone, you will have to pay double the miles. That’s why with miles, it pays to book early.

We made a minor mistake in booking our Cali-Alaska trip and ended up paying double the miles on some legs of the trip. But we found that rather than paying double for a regular economy seat, we could book the first class “saver” seat with the same amount of miles. So even though we missed the “saver-economy” tickets, at least we’ll be flying in luxury. There are hacks for every situation.

Below are some highlights from our trip to Japan back in 2014, now two babies ago.

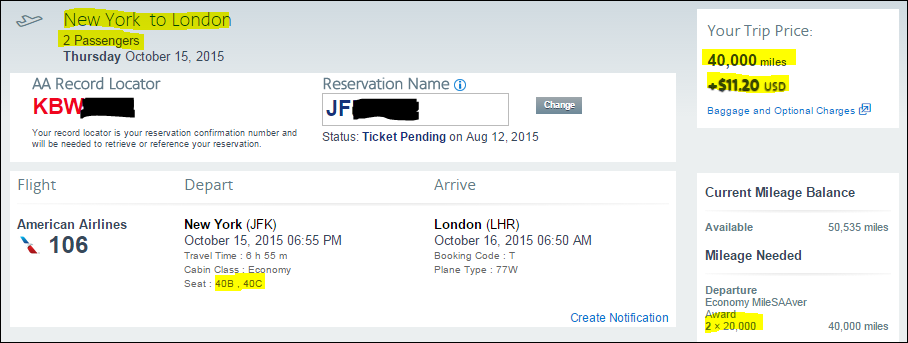

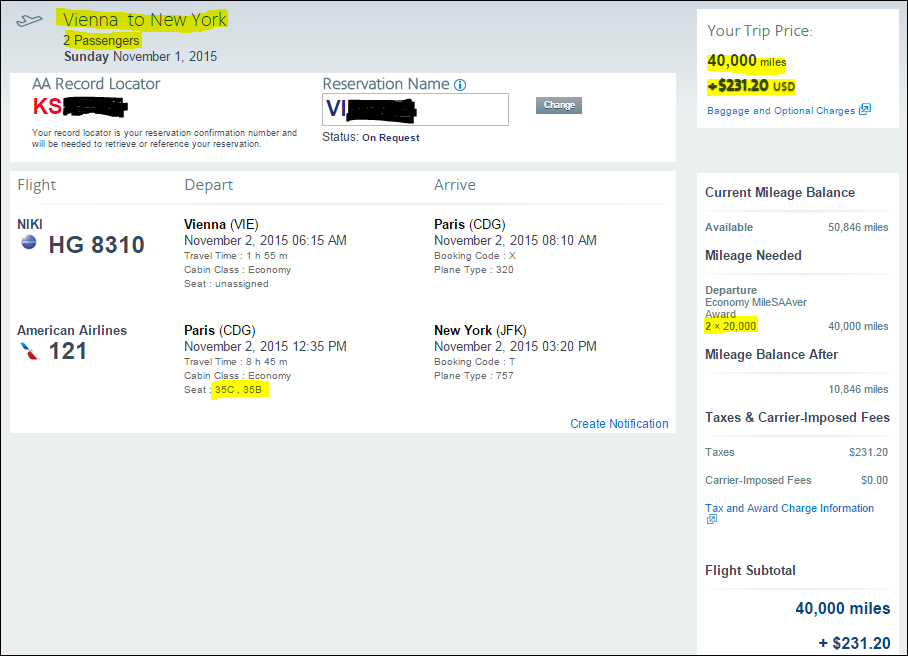

When flying as a couple, book each leg individually [Euro-Trip, American-Airlines, 40k miles (pp)]

If I had known this simple tip back then, it would have saved me a lot of trouble! When booking Japan, since my wife and I only had about 70k miles in each of our accounts at the time, we booked the whole round-trip at once for the both of us. It was a struggle because I had to first find an itinerary that had two available “saver-economy” seats (some only had one). Once I found those, I had to simultaneously, on two different web browsers, book the flight for my wife and myself as quick as I could, so no third person could jump in and grab one of the seats. Another inconvenience was that we had to be sure to pick seats side by side on our individual itineraries, but there was always the off-chance that the airlines could move or bump one of us, thinking that we were just two random passengers sitting side by side.

By our next trip (to Europe), we found a solution!! We both booked one-way tickets for the both of us!(When using miles there is no discount for round trip.)

So she booked the departure flights with her frequent flyer miles card(Both of us on same itinerary) and I booked the return flights with my frequent flyer miles card. Since it cost the same amount of miles no matter which country in Europe we flew home from, we decided to leave from Austria.

You can read the details of the three week backpacking trip across Europe with our then 6-month old at this blog post.

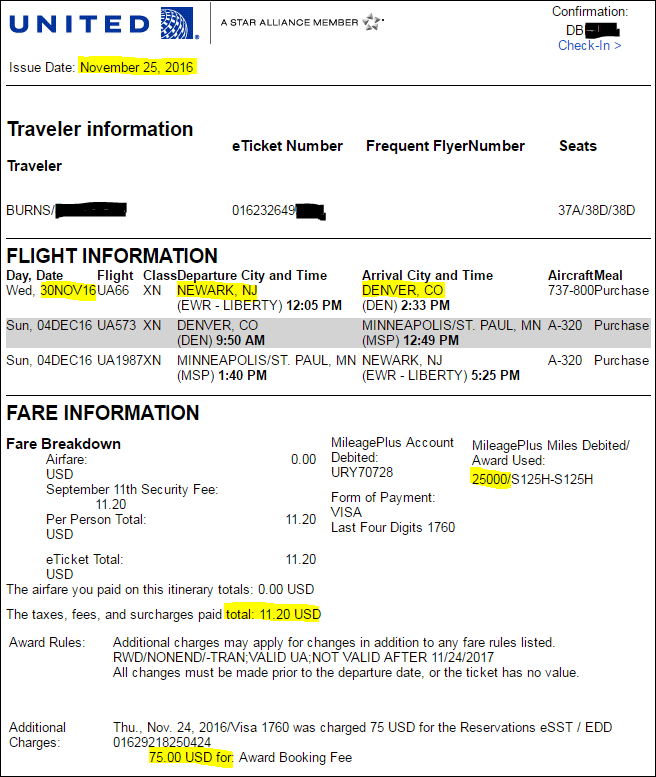

Going on a work trip? Have your family join you and make it a vacation. [Colorado, United, 25k miles]

I had a conference in Denver a couple of months back where my flight was paid for, but my wife and I both wanted to check out Colorado so we decided to make it a family vacation. (Kids under 2 years-old fly for free domestically.)

So we found a ”saver-economy” round trip flight for my wife and son. She met me on my last day of the conference, where we got to enjoy my paid-for hotel room for the night, and I changed my return flight date to extend my trip a couple days and match her return itinerary at no cost.

We were able to explore Denver, see the mountains of Vail, go to the Red Rock canyons, and visit Rocky Mountain National Park.

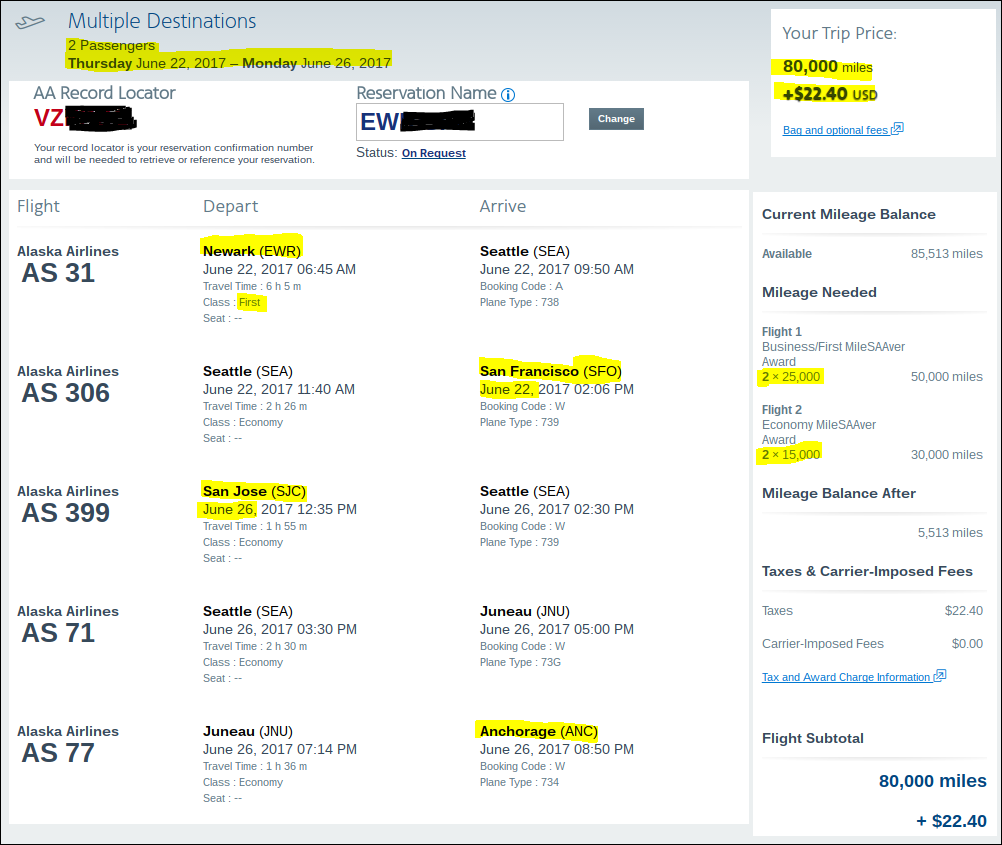

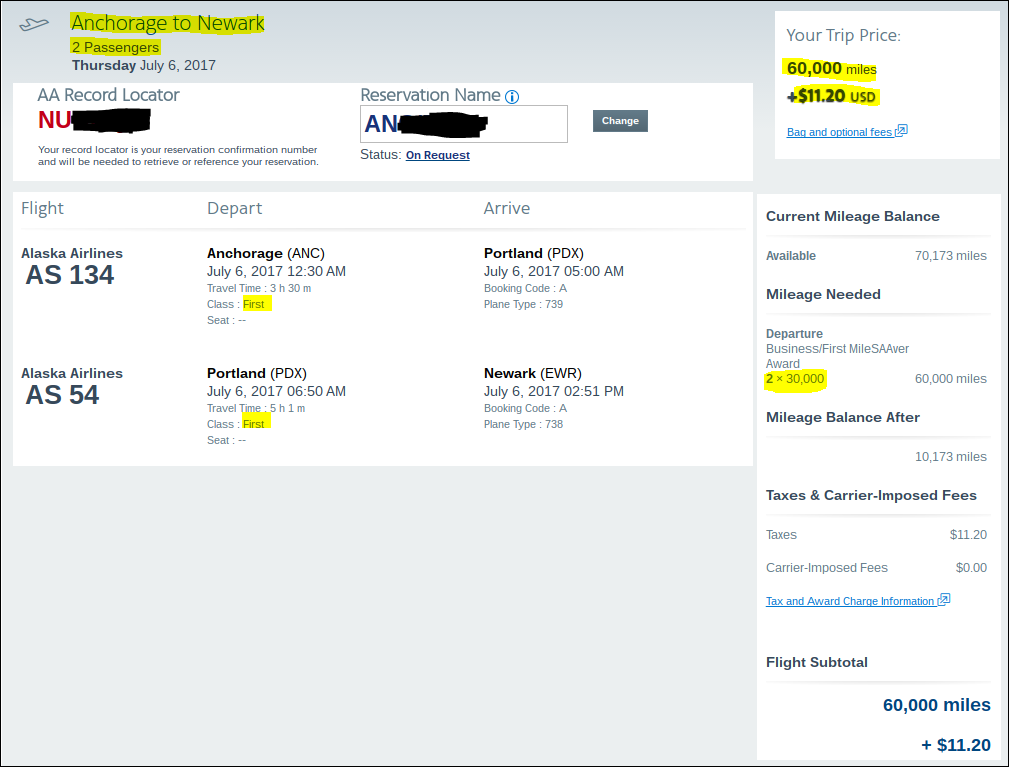

The Crazy First-Class California Wedding and Alaskan Sojurn Trip [American and Alaskan Air, 82.5k miles (pp)]

So, this is our upcoming trip and there are going to be a lot of firsts. It was booked kind of last minute and at peak season, so there weren’t any economy saver seats available – only regular economy. But the funny thing is, there were “first-class saver seats” available which cost the same amount of miles (double saver-economy) as the regular economy seat anyway.

So we booked first class!

Another first for this trip was that we booked a multi-city itinerary. We are flying from our home state of New Jersey to California for four days, then we fly to Alaska.

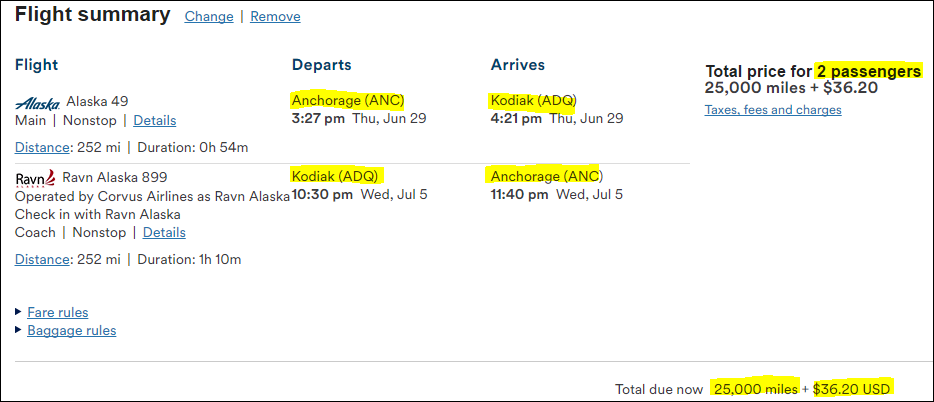

Here’s where things get really crazy! As we were planning for the Alaska leg of the trip, we really wanted to see our friend who lives on the small island of Kodiak. You can’t drive there and the planes cost ~$300 pp with very few direct flights there.

Since we were all out of miles from booking the first-class trip to Cali/Alaska and then home, we decide to open a brand new Alaska Airlines credit card just for this trip’s interstate travel. This would save us $600 bucks.

So I signed up for the card, and the day I got it, I ordered $1000.00 worth of pacifiers on it, which will be sold on Amazon FBA.

It took until the close of the first billing cycle to get our 30,000 miles, but we were still able to book that interstate flight to the small island of Kodiak to visit our friend. Yet another hack!

Here is the itinerary home, again First Class, baby!

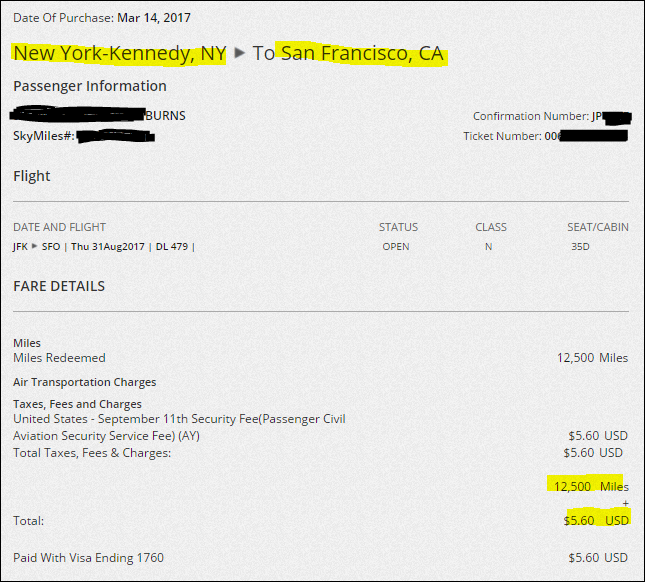

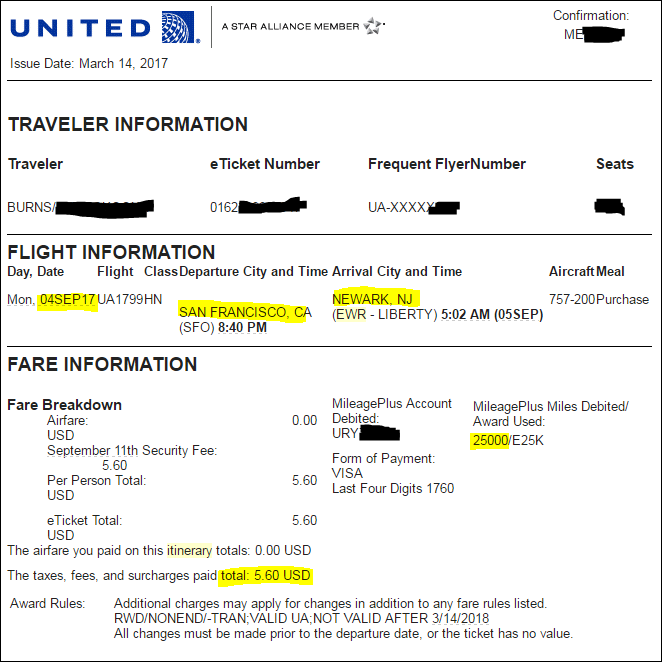

Sometimes using multiple airlines is best [Yosemite Backpacking Trip, Delta and United, 37.5k miles]

Later this summer over Labor Day weekend, my friends and I will be hiking Half-Dome during a three-day backpacking trip to Yosemite. Very excited!

I didn’t have enough miles to do it all using one airline, so I booked one leg of the trip through Delta and the other leg through United.

Lodging Hacks

Lodging can be a huge part of travel costs. We were able to cut this tax on travel essentially to zero by staying with relatives, friends, friends of friends, friends of relatives, and so on whenever possible.

During our three-week Japan stay, we only paid for one night’s lodging and that was at the 8th station FujiSan Hotel, which is a common rest pit for hikers looking to see the sunrise from atop Mount Fuji. In all other instances, we stayed with my relatives as well as my Mom’s friends all across the country.

During our two-and-half-week European backpacking trip, we again booked a hotel only once. We stayed with my wife’s relatives as well as some of her Mom’s friends during the rest of the trip.

On many trips we also leverage contacts from our global church community, the Unification Church. The faith community shares fairly conservative values and is very close-knit, so it is fairly easy to stay with a family even if you’ve never met. There is actually a 4,000+ Facebook group from members of the church community for just this purpose.

There are pros and cons to traveling this way, but we feel that the benefits outweigh the costs. Even though sometimes you aren’t exactly where you’d like to be or you’re sleeping on a couch, it’s a great way to meet new people and experience a more genuine less-touristy aspect of the place you’re visiting. Often our hosts shared with us rare local gems and things to do outside the standard commercialized tourist attractions.

Next time you travel, reach out to your network and a willing accommodation might be closer than you think.

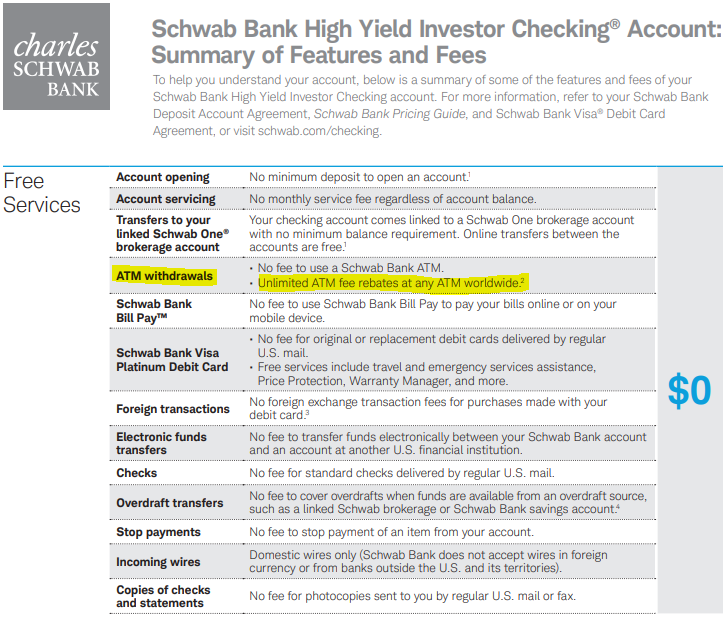

Foreign Currency Exchange Hack

I recently went on a trip to Costa Rica, and we venmo’d one of my friends who had a Charles Schwab bank account. The reason for this was, you can use the Charles Schwab debit card at any ATM in the world (including any ATM in America) and get all ATM fees reimbursed.

So if you use it in a foreign countries ATM, you get to withdraw money in that countries currency at the exchange rate with NO FEES!

As soon as I got home, I opened up my own Charles Schwab account, use the “Friends & Family” link (REFER6HXTA9TC) above to get $100 for opening an account… I don’t get anything in return, but happy to help a fellow travel hacker.

The Credit Cards we used

All the credit cards we have used to fund all these adventures are below (most we’ve opened multiple times). I will give a brief description of the Benefits and Pros/Cons of each. Please keep in mind that the bonuses are not always the same – some are targeted. For instance, a lot of times the United Explorer Card will only give you 30,000 bonus miles, and sometimes the company won’t waive the $95 annual fee on the card in the first year. There are always promotions so I suggest waiting for those to come out. So, in the case of the United card, we waited until the bonus was for 50,000 miles and for the annual fee to be waived.

Tip: Some airlines have their miles/points expire after 18 months of inactivity of the frequent flyer account. This is usually very easily resolved. Account activity can be anything – booking a trip with the miles, gaining miles, and it can even be as simple as spending 500 miles to redeem yourself a useless trinket on an airline’s frequent flyer program website. All these actions reset the 18-month clock.

United Explorer Card

Mileage: 55,000 Bonus

Spending Amount: $3000 in 3 months

Annual Fee: $95 [Waived 1st Year]

Card-Use Bonus: 1 miles per $1 spent. 2x miles on United.

Perks: Free Checked Bag, 2x United Club Passes, Car Rental Insurance, No Foreign Transaction Fee(FTE)

American Airlines Advantage Card

Mileage: 50,000 Bonus

Spending Amount: $3000 in 3 months

Annual Fee: $95 [Waived 1st Year]

Card-Use Bonus: 1 miles per $1 spent. 2x miles on AAirlines.

Perks: Free Checked Bag, No FTE

Barclay Arrival Card

Mileage: 50,000 miles

Spending Amount: $3000 in 3 months

Annual Fee: $89 [Waived 1st Year]

Card-Use Bonus: 2 miles per $1 spent.

Perks: Redeem on any travel expense(Airline, Train, Car-Rental), Get 5% redemption back. Card reimburses credit card use for travel, so no black-out dates or headaches of jumping through hoops. No FTE

Alaska Airlines Card

Mileage: 30,000 Bonus

Spending Amount: $1000 in 3 months

Annual Fee: $75 [NOT WAIVED!]

Card-Use Bonus: 1 miles per $1 spent. 3x miles on AlaskaAir related expenses.

Perks: Free Checked Bag, No FTE, Get an annual companion fare(BOGO) for $121.

AMEX Gold Premier Card

Mileage: 50,000 Points

Spending Amount: $2000 in 3 months

Annual Fee: $195 [Waived 1st Year]

Card-Use Bonus: 3x points per $1 spent on airlines. 2x points on gas, groceries, restaurants. 1x on all else.

Perks: No FTE. $100 Annual Airlines Fee Credit, Car Rental Loss & Damage Insurance, Points Transfer to many airlines.

Have At Least ONE No-Fee Card

Credit History is important, so I strongly suggest opening your first credit card with a no-fee card because you will want to keep this card for the rest of your life. You don’t necessarily have to use it, but the older the Credit line has been in existence the better. A lot of 18 year old’s will only qualify for bank credit cards, with very little rewards, but that’s okay.

My favorite No-Fee card right now is Wells Fargo’s American Express Propel Card

Mileage: 30,000 Points

Spending Amount: $3000 in 3 months

Annual Fee: $0 [No Annual Fee Forever]

Card-Use Bonus: 3x points on Food, Gas, Travel, Flights, Hotels, Car rentals, Streaming. 1x on all else.

Perks: Cell Phone Protection From Damage or Theft

Deadly Warning

So before you go off and apply for these cards, I just want to take a minute to once again tell you that credit cards can be deadly. Without discipline, they are a sure-fire way to absolute financial death and bankruptcy. You notice that I didn’t even list the Interest Rate on these credit cards. You know why? Because I don’t care… I don’t pay interest – never have, never will. If you can’t say the same, then I strongly suggest you do not get a credit card. Doing so will just be signing a contract with the credit card companies, that 15-35% of your money will be going directly to them in late interest payments.

The perks are good. But the pitfalls are much greater. You decide if your track record is good enough to risk it. There is a reason why these credit card companies offer these awesome incentives – they are not in it to lose money. On average, they make money on the suckers who buy things they cannot afford and end up having to work for the money that they don’t have. Don’t fall into this trap! It is of paramount importance to have your money working for you, not against you.

At the age of 18, you are given access to credit (with no financial education from schools). Now you have to decide whether you are mature enough to eat from the fruit of the tree of the knowledge of good and evil… done wrong and you shall fall – trapped in an almost inescapable hell, but if you do it right, it is truly a beautiful thing.

P.S. If you are already trapped in the inescapable hell of credit card debt, send me a message and I have a free resource I can send you that will help. Good luck and Godspeed!

9 thoughts on “Fly for Free: a Travel Hacking Case-Study after $10,000 in Free Flights”

Hi Sunny,

I’m trying to keep my FICO score at its current 720, and will be applying for a mortage in November, December as I’m looking to purchase an investment property. By applying and opening for travel cards as you did, is there a chance my credit score will suffer? What was your approach?

Do you recommend that I close some credit cards that I haven’t used in a while to substitute for possibly the new travel card(s)?

Hey Brad my credit score was only minutely effected with each close and seemed to bounce right back within a few months. Right now I think I’m in the 760’s.

The thing to watch for also though is the number of inquiries on your account. With every new account opening they will run your credit and a new inquiry will appear. My loan officer said that was the only thing that didn’t look great on my account. I had like 10 at that point so just had my Wife open cards in her name while doing the mortgage process.

I only cancel cards that have annual fees, if they don’t have annual fees then I just stop using them and forget about them. I figure they will only add to my available credit amount. Hope that helps.

Hi Sunny,

I’ve come across a travel card offer for $30K miles, annual fee waived and spending requirement of $1K in 3 months. Would you say that’s a respectable amount of miles (30K)? By looking at your trip summary it appears it is but just wanted to get your confirmation?

Hey Brad, I usually only open up cards for a 50,000+ bonus. 30k miles is kind of the normal bonus. I’ve only once opened a card that was less that 50k and that was for Alaskan Airlines, and only because I had to book an interalaskan flight that they were the only ones that ran it. So my recommendation would be to hold off until a promotional bonus appears. From a quick-search I didn’t see any fee-waived cards right now, but there is this, which could be worth your while: https://slickdeals.net/f/10484784-southwest-rapid-rewards-plus-premier-credit-cards-60k-points-w-2k-spent-in-1st-3-months?src=SiteSearchV2_SearchBarV2Algo1

SKB–You’re deadly warning was written excellently. It almost sounded like poetry. Good Job.

Book related. On your recommendation I’m going to try and read The 5 love languages with Mommy. I’d like to see what she thinks and I should also give it another chance–maybe a slow read.

Hello Sunny, do you continue to travel for free using this method in 2018? If so, what has been your latest trips this year? My concern is having so many inquiries on my credit report?

Hey Brad, yes I just took a free round trip to Costa Rica this past September. Also going to Bermuda tomorrow, but that’s via a cruise (still in the middle of writing a post about cruising for cheap).

Anyway I wouldn’t be so concerned about all the inquiries, In the last 15 months or so, Ive opened 3 new cards, a mortgage, a heloc, and am applying for another heloc right now. And I now have exactly a 800 credit score.

Just listened to your podcast and wanted to add something sweet to a particular flight. We used American airlines card to go to Japan and we were able to use there partner airline JAL. The service is superior and it was a great trip. So I think also that using partnering airlines can be sweet.

Bruce and Yoko

Great!